The Best Pet Insurance

We spoke with industry professionals, processed over 500 online quotes and reviewed over 100 individual policy sections to determine that Healthy Paws is the best pet insurance. They offer one simple plan that minimizes confusion, covers all illness and injury and sets some of the most affordable rates on the market — plus policyholders rave about their outstanding customer service. For a plan that includes routine vet care, check out Nationwide’s Whole Pet with Wellness.

We spoke with industry professionals, processed over 500 online quotes and reviewed over 100 individual policy sections to determine that Healthy Paws is the best pet insurance. They offer one simple plan that minimizes confusion, covers all illness and injury and sets some of the most affordable rates on the market — plus policyholders rave about their outstanding customer service. For a plan that includes routine vet care, check out Nationwide’s Whole Pet with Wellness.

Table of contents

- How we selected finalists to test

- Compare the best pet insurance companies

- Who needs pet insurance?

- Policy types and coverage

- How pet insurance works

- Important features to consider

- How we evaluated

- Best overall: Healthy Paws

- Best rates: Pets Best – Plus Plan

- Best wellness plan: Nationwide – Whole Pet

- Other finalists we evaluated

How we selected finalists to evaluate

Pet insurance is a mixed breed that straddles human health care and property insurance. As a fairly new industry, it can be a confusing topic. We turned to the North American Pet Health Insurance Association (NAPHIA) for guidance. NAPHIA aims to improve pet insurance standards as well as public awareness. We learned from NAPHIA that there are roughly a dozen pet insurers that cover the United States and Canada.

Our research began by looking at consumer ratings on third-party review sites such as Pet Insurance Review and PetInsuranceQuotes.com (recently acquired by Petco). We read pro tips from veterinarians like Dr. Doug Kenney at PetInsuranceGuides.com and Dr. Frances Wilkerson at Pet Insurance University. In-depth reviews on Wirecutter and Reviews.com further rounded out our study.

We next analyzed the types of insurance plans offered by each company. Every insurer takes a different approach. Most include more than one plan type. We picked through websites page by page, gleaned missing info from FAQs and downloaded sample policies to get into the details.

Boned up on fundamentals, we narrowed down our finalists to only include plans that cover both illness and injury, known in the insurance world as a “comprehensive plan.” To further cull the group, we eliminated all plans that capped the dollar amount the insurer would cover; having an “unlimited” payout ensures your pet will be covered for whatever emergency comes up.

This process eliminated common brands like Petfirst and Embrace Pet Insurance. Lastly, we identified companies backed by the same underwriter (essentially same policy, just different branding) and went forward with the ones that had the more favorable customer reviews.

Compare the best pet insurance companies

| Insurer/Plan Name | Price | BBB Rating | Year Founded | 24/7 Customer Care? |

|---|---|---|---|---|

| 1. Healthy Paws | $ | A+ | 2009 | No |

| 2. Pets Best - Plus Plan | $ | A+ | 2005 | Yes |

| 3. Nationwide - Whole Pet with Wellness | $$ | A+ | 1982 | Yes |

| 4. Trupanion | $$ | A+ | 2000 | Yes |

| 5. ASPCA - Complete Coverage | $ | A+ | 1997 | No |

| 6. Figo - Ultimate | $$$ | A | 2015 | No |

| 7. Petplan | $$$ | A+ | 2003 | Yes |

Who needs pet insurance?

Pets have moved from sleeping in the barnyard to the backyard to the foot of the bed — or, for some of us animal lovers, with their heads on the pillows. During our research phase, we came upon one subreddit post that summarizes it well: “If you are the kind of pet owner who would spare no expense for your pet’s health, pet insurance is an absolute must.”

According to NAPHIA’s 2018 State of the Industry Report, pet insurance in the US doubled in size between 2013-2018, growing from a $500M industry to just over a $1B industry. This rapid growth has outpaced the industry’s ability to educate consumers. As noted among the 100 pet insurance facts compiled by PetInsuranceQuotes.com, the number one reason people buy pet insurance is because they “want to make decisions about their pet’s health care without worrying about whether or not they can afford treatment.”

That last point emphasizes the true value of pet insurance: peace of mind. Though some plans pay exam fees, the main benefit of health insurance is to cover high-cost, unexpected illnesses and injuries. A solid policy means you won’t need to worry about draining your savings account or euthanizing your pet because you can’t pay the vet costs, a dreadful situation known as “economic euthanasia.”

There’s a prevailing mindset, advanced by pet insurance companies like Trupanion and Healthy Paws, that you shouldn’t use pet insurance to pay for routine care. In fact, most pet insurers exclude preventive care from their plans. It’s the unforeseen, expensive care you need to guard against, such as the following high-cost claims (this info is taken from Trupanion’s testimonials page and Healthy Paws’ home page).

Sample coverage of high-cost claims

| Condition | Pet Type | Treatment Cost |

|---|---|---|

| Brain Stem Tumor | Dog | $30,160 |

| Pancreatitis | Dog | $22,900 |

| Gallbladder | Dog | $11,670 |

| Urinary Obstruction | Cat | $19,030 |

| Intestinal Surgery | Cat | $15,700 |

| Congestive Heart Failure | Cat | $13,060 |

It’s best to enroll your pets while they are young. Most insurers let you enroll as early as eight weeks. Not only does that get you the lowest rates, it also provides the best chance your pet won’t be diagnosed with a pre-existing condition that won’t be covered (more on that below). Most insurers let you begin enrollment around seven to eight weeks old.

Pet insurance is also a wise investment for people who own purebred dogs or cats. By comparison, mixed breeds have more diverse bloodlines that make them hardier. Purebreds, on the other hand, are more susceptible to certain high-risk conditions. Before enrolling your purebred, talk to your vet about which diseases your breed might be predisposed to, then make sure those conditions are covered by your prospective insurer.

How much should I expect to pay?

NAPHIA’s 2018 State of the Industry Report indicates dog owners paid an average annual premium of $536 in 2017 for accident-and-illness plans; cat owners averaged $336. That equates to about $45 for a dog’s monthly premium and $28 per month for a cat. The report shows premiums have increased on average at about 6 percent per year 2013-2017.

We spoke with Kristen Lynch, executive director of NAPHIA, and learned one reason premiums increase is due to advances in vet technology. New devices enable veterinarians to perform more sophisticated procedures; these improvements cost money, which is in turn passed on to policyholders in the form of higher premiums. That’s the trade-off for access to better treatment — and when your pet is on the operating table, what pet parent doesn’t want them to have the best care they can get?

Is pet insurance worth the investment?

That’s precisely the question Consumer Reports tried to answer in this article. As pointed out in their review, it’s an incredibly tough question to answer because every pet has potential to suffer different conditions. An indoor, mixed-breed cat is less likely to need vet care than an active purebred dog who’s bloodline is subject to hip ailments. Your vet can advise you on how likely your specific breed is to develop a costly chronic condition, but there’s no guarantee that any breed won’t develop cancer. Per that CR article, it’s about “playing the odds”.

And odds are you may never see a return on the monthly premiums you pay out. However, what you’re really investing in is peace of mind from knowing your pet will receive essential vet care should the need arise. That’s really no different than insurance for people: In the United States, we pay enormous premiums for health coverage, but we never actually hope to suffer a stroke or heart attack so that all those monthly payments will zero out.

Now, if you’re one of the unlucky few whose pet requires ongoing care, such as for cancer or diabetes, then your investment will more than pay for itself. That’s how insurance systems work: Many people pay into the system so that those few who actually need treatment will be covered.

Policy types and coverage

Types of insurance policies, rates and covered conditions vary widely between insurers. The three common policy types are:

- Comprehensive: These plans cover both illness and injury. Since you can’t predict which conditions will affect your pet over their lifetime, this is the safest, most inclusive coverage you can get. Premiums cost more, but you also get a lot more.

- Injury-only: Sometimes labeled “Accident-only,” these plans only cover physical injury to your pet. Monthly premiums are much less than for comprehensive plans, but so is your coverage. You might consider an injury-only policy if you’re on a tight budget and have an energetic pet who likes to explore hazardous situations.

- Wellness-only: These plans cover routine exams as well as preventive care such as vaccinations, flea and tick control, deworming and dental.

Some insurers offer only of these plan types, and few insurers offer all three. Here’s a snapshot of how each type can vary in price.

Sample plans and pricing for 3-year-old mixed-breed dog

| Policy Type/Insurer | Deductible | Reimbursement / Co-pay | Annual Payout Limit | Monthly Premium | Total Annual Premium |

|---|---|---|---|---|---|

| Comprehensive Healthy Paws | $250 | 90% / 10% | Unlimited | $45 | $539 |

| Accident-only Pets Best - Accident Plan | $250 | 90% / 10% | $10,000 | $11 | $132 |

| Wellness-only Nationwide - Wellness Plus | $0 | Per Specific Care | $500 | $22 | $264 |

Although the lower-cost accident-only and wellness plans may seem appealing, coverage is substantially less. Consumers appear to grasp the value of going the comprehensive route. NAPHIA reports that in 2017 an overwhelming 98 percent of U.S. pet owners chose to purchase comprehensive policies; only two percent opted for accident-only plans. Of the three bulleted policy types above, only comprehensive plans cover both illness and injury/accident, making it the plan type we recommend.

Many insurers offer supplemental wellness care on top of their base comprehensive plans. These add-ons, called riders, tack on coverage for preventive, behavioral or naturopathic treatments. Monthly premiums increase by about $25. In our opinion, it’s better to forego these riders. You’ll need to pay for routine care, but the money you save in reduced premiums (about $300/year) should easily cover annual vet exams and routine care.

What pet insurance covers

Benefits are the specific types of vet care for which you are insured and will be reimbursed. Comprehensive insurance policies help pay for the vast majority of ailments and injuries, and may extend to certain types of preventive care such as vaccinations. It all depends on what’s listed in your policy. To gain that essential peace of mind, a good insurance policy covers at least the following:

- Chronic conditions such as cancer and diabetes

- Hereditary and congenital conditions

- Surgeries and hospitalization

- MRI or CT scans, X-rays, ultrasounds and lab tests

- Vet-prescribed medications

Most insurers only cover dogs and cats. The one exception is Nationwide’s Avian & Exotic Pet Plan, which covers animals such as birds, rabbits, turtles and snakes. Yes, they even cover iguanas and potbellied pigs.

With any policy, the common stipulation is that your pet must receive care from a licensed veterinarian. However, unlike health insurance for people, most plans let you choose your preferred vet.

What it doesn’t cover

Let’s start with the big one. No pet insurance company covers “pre-existing conditions.” If your vet records list a previous illness or injury, or if your vet discovers an issue during an enrollment exam, the insurer will not cover that condition should it recur. This is especially relevant to older pets that are more likely to have experienced an issue in the past.

When you analyze a sample policy, you’ll find it’s more about what’s listed as “not covered” than covered. Common exclusions include:

- Preventive care

- Spaying or neutering, pregnancy and birthing

- Microchipping (your local Humane Society can do this for about $15)

- Special foods, dietary supplements or vitamins

- Behavioral training or therapy

Be sure to check out our “Important features” section below for more tips on specific provisions to look for in a policy.

How pet insurance works

Whether for pet or person or auto, insurance can be a highly confusing topic. So we’re going to go slow and break down each concept. The clearest way to explain pet insurance is to walk through the typical process step-by-step.

Step 1: Compare quotes and sample policies to choose an insurer.

The quote is the estimated cost you will need to pay each month. Additionally, most insurers let you download a sample policy that details your contractual relationship. Use this research to select an insurance company, referred to as your insurer.

Step 2: Enroll your pet.

Assuming your pet meets age requirements, submit all required paperwork — and be sure to thoroughly review your official policy. Your insurer will obtain medical records (if they exist) from your preferred veterinarian, referred to as your provider. Some companies also require a vet exam to enroll.

Step 3: Pay your monthly premium.

The premium is the dollar amount you owe your insurer each month. Most companies let you set up automatic payment from your bank.

Step 4: Pay your next vet bill.

At your next vet appointment, you need to cover all vet fees out of your own pocket (such as by debit or credit card). This is the case whether or not your insurer covers the specific type of vet care received. For covered treatments, you will be reimbursed later.

Step 5: Meet your deductible.

The deductible is the dollar-amount threshold you must pay before your insurer begins paying any vet fees. It only applies to covered conditions. Once you meet your deductible, the insurer covers the majority of all costs for the rest of that year. This remains in effect until start of following year when the deductible resets to zero and you must again reach the threshold before coverage kicks in.

Step 6: Pay your co-pay percentage.

After you meet your deductible, you are still responsible for a co-pay portion of the total vet bill. This ranges from 10-30 percent. Your insurer covers the remaining cost, referred to as the reimbursement percentage (usually 70-90 percent). You must submit your co-pay for each covered condition for the rest of the given year.

Step 7: Submit a claim to your insurer.

Send a copy of your vet receipt to the pet insurance company. Many insurers have mobile apps that let you upload a photo of the receipt. Most also allow you to send by email, regular mail or even by fax.

Step 8: Receive reimbursement.

The insurer reviews and processes your claim. Once approved, your insurer issues reimbursement (by check or direct deposit) to cover your out-of-pocket expenses. Depending on the company, claims processing can range from a few to over 30 days.

A key takeaway from above is that pet insurance operates as a reimbursement system. Unlike people’s health insurance, the system works similar to auto insurance, another form of property/casualty insurance. At the time of your vet appointment, you pay the full vet bill from your own bank account or credit card, then the insurer pays you back (less the co-pay, of course). If you find yourself facing a very expensive vet bill, don’t despair — try looking into one of these financial aid resources posted by the Humane Society.

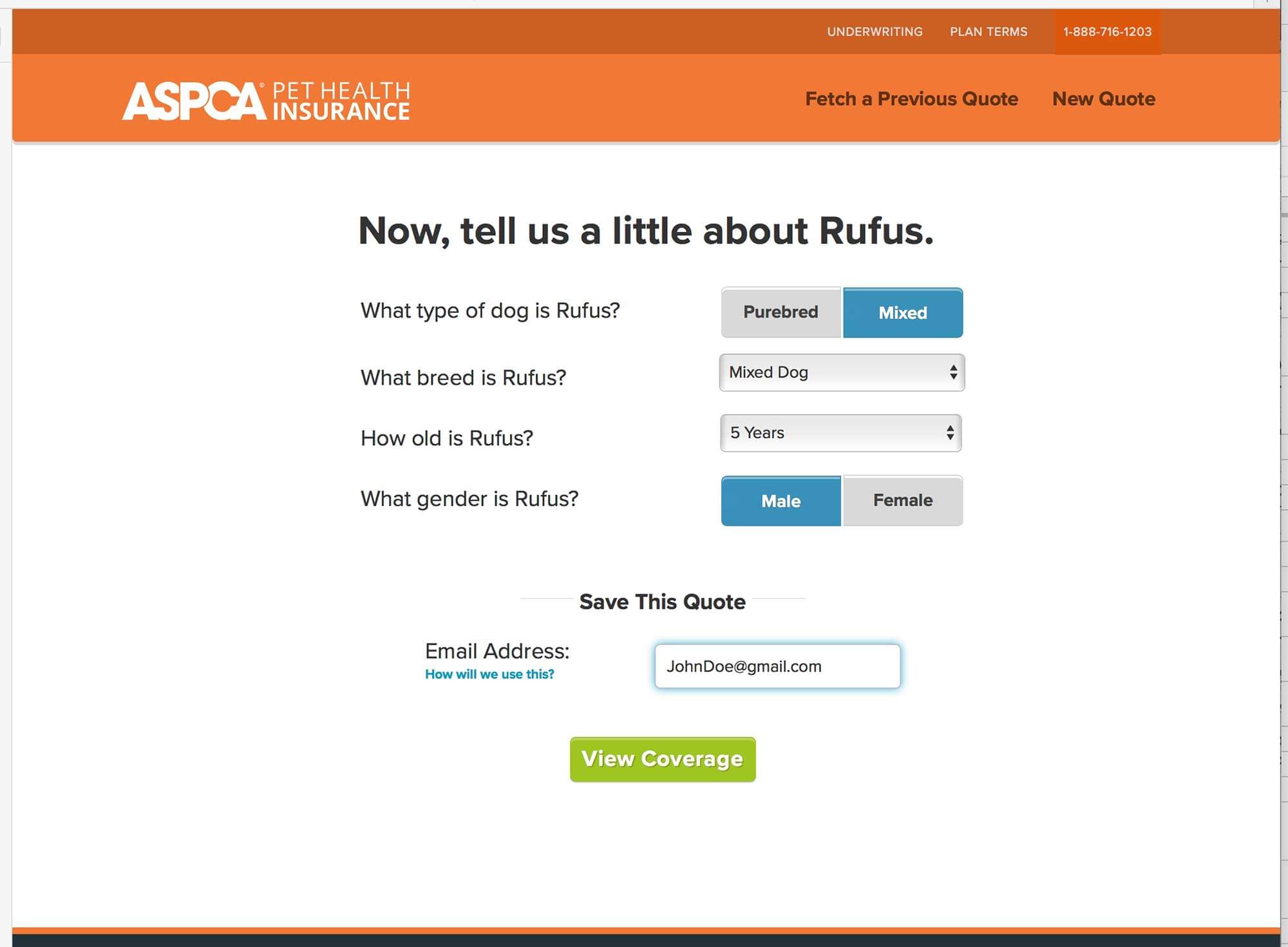

Getting your first quote

All of our finalists’ websites offer online quote calculators that are simple, fast and intuitive to use. This is an invaluable tool for comparing quotes between insurers. Each site requires you to enter an email address. We worried about being deluged with endless pesky emails, but it honestly wasn’t that bad, and you can unsubscribe at any time.

First, enter your pet’s information. These factors will set the baseline cost. If you want to insure more than one pet, you’ll have that option later.

- Pet type: Select dog or cat. Dog premiums cost one-third to twice as much as cats.

- Gender: Select male or female. When we ran our quotes, we did not see any cost difference for male versus female.

- Age: Your insurer will use the birth date listed on pet’s medical records. If you don’t have any records, most insurers will use your vet’s best estimate.

- Breed: Each site has a lengthy drop-down list of purebreds. You can also select “mixed breed,” in which case you might be prompted to specify your pet’s size.

- Zip code: Your pet must reside with you at this address.

- Email: You need to enter this info to advance to the quote screen.

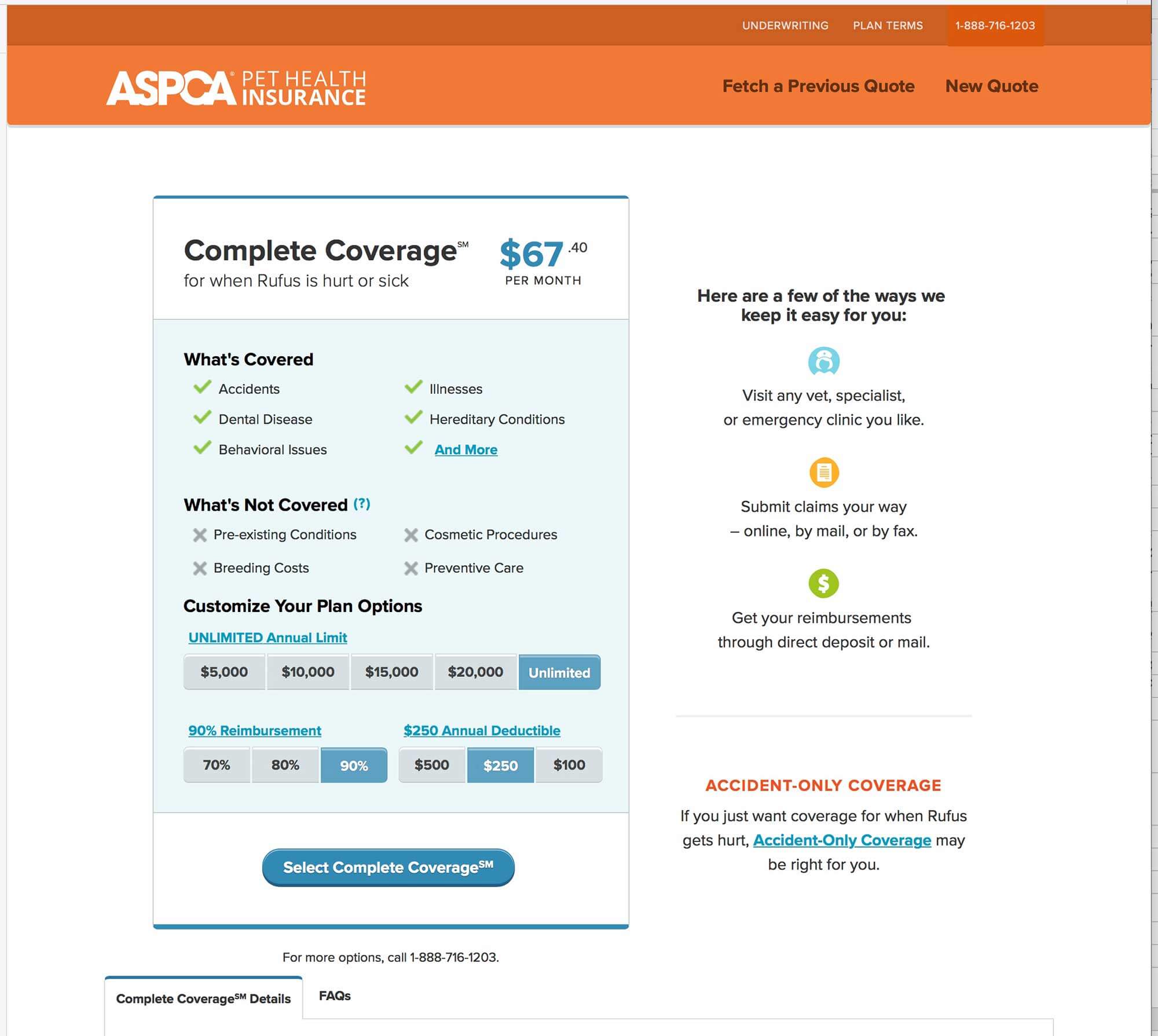

Next, adjust variables to estimate your monthly premium. This is the crux of the matter — determining how much you will need to pay per month. While options vary by insurer (as is the case with all things in the insurance world), there are three main variables. Most insurers let you customize these settings.

(1) Annual limit: This is maximum amount your insurer will pay out each year. It typically starts at $5K and maxes out at $15k or $20K. Or you can go the “Unlimited” route and rest assured you’ll be covered for anything that comes up.

- A higher annual limit increases your monthly premium, but you’ll be covered for expensive treatments (especially if you go Unlimited).

- A lower annual limit reduces your premium, but you’ll be on the hook for any vet fees that exceed your limit.

(2) Annual deductible: This is the amount you must pay before coverage from your insurer kicks in. It typically ranges from $100 to $500, though some go up to $1,000.

- A lower annual deductible increases your monthly premium, but if your pet needs treatment you’ll pay less to reach your deductible, at which point your insurer begins covering vet costs.

- A higher annual deductible reduces your monthly premium, but you’ll pay more out-of-pocket vet fees each year to reach your threshold.

(3) Reimbursement percent: Think of this as your co-pay. For example, if you choose 80-percent reimbursement, you will be responsible for 20 percent of the vet fee. The common options are 70, 80 or 90 percent.

- A higher reimbursement percent increases your monthly premium, but you’ll pay less in out-of-pocket co-pay fees.

- A lower reimbursement reduces your monthly premium, but your out-of-pocket co-pay fees will cost you more.

We encourage you to visit a few sites and give each one a try. It’s remarkably easy to adjust sliders and buttons to find a premium you can afford; watch your monthly premium go up or down as you toggle different options. But there’s more to consider than just the numbers, which we’ll get into next.

Important features to consider

Plan eligibility and variables

| Insurer/Plan Name | Age Eligibility | Deductible Options | Reimbursement Options | Annual Limit Options |

|---|---|---|---|---|

| 1. Healthy Paws | 8 wks min 14 yrs max | $100, $250 or $500 ($750 at age 8+) | 70%, 80% or 90% (60% at age 8+) | Unlimited |

| 2. Pets Best - Plus Plan | 7 wks min No max | $50, $100, $200, $250, $500 or $1,000 | 70%, 80% or 90% | $5,000 or Unlimited |

| 3. Nationwide - Whole Pet with Wellness | 1 yr min 10 yrs max | $100 (Only option) | 90% | Unlimited |

| 4. Trupanion | 8 wks min 14 yrs max | $0 up to $1,000 | 90% | Unlimited |

| 5. ASPCA - Complete Coverage | 8 wks No max | $100, $250 or $500 | 70%, 80% or 90% | $5K > $10K > $15K > $20K > Unlimited |

| 6. Figo - Ultimate | 8 wks min No max | $50 up to $1,500 (Varies by age) | 70%, 80%, 90% or 100% | $10K or $14K or Unlimited |

| 7. Petplan | 6 wks min No max | $250 up to $1,000 ($50 increments) | 70%, 80% or 90% | $2.5K > $5K > $10K > $15K > $20K > $25K > Unlimited |

Comparing quotes is important, but here are the other critical factors that should shape your decision.

Pet’s age: The sooner you start, the lower your premiums (start at age one if possible). If you first enroll your pet when they are age seven to eight, when dogs and cats start to enter their geriatric years, you may find the monthly premiums beyond what you can afford. Many insurers will not enroll pets after they turn 14-years-old.

Monthly premium: Take a hard look at your monthly budget and figure how much you can afford to pay. This is really a matter of personal income. Be aware that your monthly premium will likely increase a bit each year. This is due to (1) rising costs of vet care, and (2) some companies raise premiums as pets grow older and more susceptible to illness.

Policy document: The official policy specifies the legal terms and conditions of your contract. Fortunately, most insurers avoid too much legalese and instead use language that’s easy to understand. Be sure to dissect every paragraph. If there’s anything you don’t understand, don’t hesitate to contact customer support.

“Exclusions” and “limitations”: These two policy sections require very close scrutiny.. Exclusions are conditions that aren’t covered at all. Limitations impose restrictions. Since the primary value of pet insurance is to cover high-cost treatments, be sure you are fully covered for these big-ticket issues.

- Chronic conditions: This type of care is ongoing from year to year, including cancer and diabetes. That means costs can really add up. Never accept restrictions on chronic disorders.

- Hereditary conditions: These genetic disorders are passed down bloodlines. This coverage is most important for purebreds. Hip dysplasia, epilepsy and intervertebral disc disease (IVDD) are common examples.

- Congenital conditions: These are issues that your pet developed in utero (i.e., pre-birth). Examples include heart disease, nervous system issues, cataracts and liver disease.

Maximum payout: This is a type of limitation you need watch out for. We strongly recommend you avoid plans that include any of the following payment cutoffs.

- Lifetime limit: This is the maximum amount the insurer will pay out over the lifetime of your pet. Once you hit the dollar amount threshold, the insurer stops reimbursing costs and your policy will be terminated.

- Per Incident limit: This is the max amount your insurer will pay out for a specific illness or injury. Once you reach the limit, they will no longer issue reimbursement for that specific condition, though you will still be covered for other issues. We eliminated AKC’s “Companion Plus” plan due to this provision (a rep told us they may soon be getting rid of this limit).

- Benefits schedule: This is a line-item list of covered conditions along with the max amount the insurer will pay for each one. These price limits are supposed to be based on typical medical costs, but there’s no way to guarantee how much your vet will actually charge. Avoid this claims structure. For example, Nationwide’s “Whole Pet with Wellness” is a good comprehensive plan, but their “Major Medical” plan uses a benefits schedule that we recommend you steer clear of.

Waiting period

| Insurer/Plan Name | Illness Wait Period | Injury/Accident Wait Period |

|---|---|---|

| 1. Healthy Paws | 15 days | 15 days (12 months for hip dysplasia) |

| 2. Pets Best - Plus Plan | 14 days | 3 days (6 months for cruciate ligament conditions, cannot be waived by exam) |

| 3. Nationwide - Whole Pet with Wellness | 14 days | 14 days |

| 4. Trupanion | 30 days | 5 days |

| 5. ASPCA - Complete Coverage | 14 days | 1 day (14 days for knee and ligament conditions) |

| 6. Figo - Ultimate | 14 days | 5 days (6 months for cruciate ligament and patella conditions, can be waived by exam) |

| 7. Petplan | 15 days | 5 days (6 months for cruciate ligament conditions, can be waived by exam) |

Wait periods: Think of this as a probation period. The clock begins ticking down starting from the day of your enrollment. If your pet acquires an illness or injury during this time, it will be considered pre-existing and that specific condition will not be covered. There are two types of wait periods, and each varies per insurer: illness (1-30 days) and injury/accident (1-15 days). Many insurers impose longer wait periods for hip and knee conditions. Look for the terms “hip dysplasia” and “cruciate ligament” or “patella” in your policy. These special wait periods can extend from six up to 12 months.

Location: Urban areas cost more than rural areas, which reflects the cost of vet care in different regions. Also, plans vary by state because insurers need to have their policies legally approved by each state’s regulatory boards. When you review a sample policy, make sure it applies to the state where you live.

Discounts: Most every insurer offers some form of discount. A multipet discount for two or more animals is most common and usually set at 5 percent. Some offer a savings if you pay your premium annually rather than monthly. Others apply a discount if your pet is spayed/neutered or if you have military status.

Claims process: Once you pay your vet bill, you want to receive reimbursement quickly and painlessly. Most insurers offer a mobile app that lets you upload a photo of your vet bill. Under 10 days is a good timeframe for reimbursement, but some insurers take up to 30 days. To help speed things up, take advantage of direct deposit, now offered by many companies.

Customer Support: During our research phase, we found all our finalists’ support staff to be friendly and knowledgeable. Wait times were short. Some insurer websites even feature live chat to field quick questions. Once you narrow down your insurers, it’s worth taking the time to read consumer reviews on Pet Insurance Review to hear what others are saying.

Can I change insurers?

You are free to switch to another company — but it’s not recommended. First, any issues recorded in your pet’s medical records will be deemed “pre-existing conditions” by your new insurer and therefore will not be covered. Second, you will essentially be starting new; if your pet is older (especially if beyond age 7), expect your monthly premium to increase significantly. A waiting period also applies anew.

How we evaluated

Consumer review scores

| Insurer/Plan Name | Pet Insurance Review | Trustpilot | Consumers Advocate | Pet Insurance Quotes | Canine Journal |

|---|---|---|---|---|---|

| 1. Healthy Paws | 9.8 | 9.7 | 9.8 | 9.6 | 9.3 |

| 2. Pets Best - Plus Plan | 9.0 | 9.1 | 7.8 | 8.6 | 9.1 |

| 3. Nationwide - Whole Pet with Wellness | 9.4 | NA | 8.5 | 8.6 | 7.4 |

| 4. Trupanion | 9.5 | 9.0 | 9.6 | 9.2 | 7.1 |

| 5. ASPCA - Complete Coverage | 9.0 | 9.3 | 7.6 | 8.8 | 7.6 |

| 6. Figo - Ultimate | 7.7 | 9.2 | 8.0 | 8.4 | NA |

| 7. Petplan | 9.2 | 9.2 | 8.9 | 8.8 | 8.6 |

Since it’s not realistic to acquire pet insurance from each company and then test for many years, we looked at consumer reviews on five popular websites: Pet Insurance Review, Trustpilot, ConsumersAdvocate.org, Canine Journal and PetInsuranceQuotes.com. In addition to the scores, we scanned to learn what people find most important.

As we combed through customer reviews, the number one complaint was being denied coverage by claim departments. Many gripes seem legit, but it also appears a lot of people don’t understand their policy. It’s critical to know your annual limit, how preventive care applies and which treatments aren’t covered due to any specific exclusions or limitations.

Healthy Paws consistently received the highest customer reviews across all four sites. Trupanion is also highly reviewed on two of the four sites. Coming in with fewer positive reviews, Figo has some catching up to do, but that’s likely because they’re a fairly new company and still building up a customer base.

Quote comparisons

To compare apples to apples, we first established our baseline criteria. We used male pets for simplicity (same rate for both genders), set size at medium (for dogs only), located ourselves in San Diego and acquired quotes for four different age groups based on subdividing from the age-13 upper limit. We set our three important variables as follows:

- Annual limit: As discussed above, an “unlimited” payout is the only way to ensure you’re covered for those break-the-bank situations.

- Deductible: We reasoned that our main goal is to be covered for those rare high-cost conditions. So we chose to go with $500 to keep our monthly premiums lower (some deviations noted below).

- Reimbursement percentage: We saw only a small cost bump ($5-$10/month) to go from 80 to 90 percent. We went with 90 percent to minimize our co-pay.

For the charts below, it’s important to point out that these costs are for newly enrolled pets — so if you enroll your pet at age one when your rate will be lowest, expect annual premiums to creep up due to inflation and rising vet costs, but you shouldn’t pay anywhere near the rates for a nine- or 13-year-old dog as shown in these charts. Still, we think these age/rate comparisons are a good reflection of each insurer’s overall pricing.

We should further point out that Nationwide’s – Whole Pet with Wellness plan has a set $100 deductible (that’s the only option). Also, Healthy Paws uses fixed rates for pet age eight and older. You’ll see these noted throughout the charts below.

Table A: $500 deductible for mixed-breed dog (medium size) in San Diego

| Insurer/Plan Name | Duke: Age 1 | Rufus: Age 5 | Wags: Age 9 | Bruno: Age 13 |

|---|---|---|---|---|

| 1. Healthy Paws | $34 | $48 | $44 (Set plan: $750 deduct., 60% reimb., no annual limit) | $69 (Set plan: $750 deduct., 60% reimb., no annual limit) |

| 2. Pets Best - Plus Plan | $33 | $44 | $94 | $140 |

| 3. Nationwide - Whole Pet with Wellness | $58 ($100 deduct.) | $80 ($100 deduct.) | $124 ($100 deduct.) | $190 ($100 deduct.) |

| 4. Trupanion | $54 | $77 | $111 | $162 |

| 5. ASPCA - Complete | $45 | $55 | $103 | $145 |

| 6. Figo - Ultimate | $61 | $94 | $144 | $223 |

| 7. Petplan | $49 | $91 | $182 | $316 |

Mixed-breed dogs and cats are less prone to genetic ailments, which translates to lower premiums. The mixed-breed category serves as our benchmark for comparing others.

Right away, you can see how much less expensive rates are if you enroll your pet when it’s young. Again, rates increase over time, but if you enroll your dog at age one, your premium shouldn’t jump up to the cost shown for a five-year-old in the above chart.

Pets Best – BestBenefit Plus Plan and Healthy Paws offer the lowest rates. On the high end, Figo leads off with priciest rates but is surpassed by Petplan as dogs enroll at more senior ages. ASPCA – Complete Coverage is the midrange low and Trupanion is the midrange high.

To get a fuller perspective, we also ran quotes for a $250 deductible with all other criteria set the same. See chart below.

Table B: $250 deductible for mixed-breed dog (medium size) in San Diego

| Insurer/Plan Name | Duke: Age 1 | Rufus: Age 5 | Wags: Age 9 | Bruno: Age 13 |

|---|---|---|---|---|

| 1. Healthy Paws | $41 | $58 | $44 (Set plan: $750 deduct., 60% reimb., no annual limit) | $69 (Set plan: $750 deduct., 60% reimb., no annual limit) |

| 2. Pets Best - Plus Plan | $45 | $61 | $130 | $193 |

| 3. Nationwide - Whole Pet with Wellness | $58 ($100 deduct.) | $80 ($100 deduct.) | $124 ($100 deduct.) | $190 ($100 deduct.) |

| 4. Trupanion | $72 | $104 | $151 | $221 |

| 5. ASPCA - Complete | $56 | $67 | $127 | $178 |

| 6. Figo - Ultimate | $70 | $107 | $165 | $223 (Fixed $500 deduct.) |

| 7. Petplan | $68 | $127 | $256 | $446 |

Again, you need to pay vet costs out of pocket until you meet your deductible, at which point the insurer covers all costs except your co-pay. You’ll reach the threshold faster with a lower deductible, but monthly premiums are higher. Comparing rates for a $250 versus $500 deductible, costs range $10-$15 higher at age one; after that, they escalate considerably. We think a $500 deductible is more affordable for the average consumer.

Table C: $500 deductible for mixed-breed cat in San Diego

| Insurer/Plan Name | Bandit: Age 1 | Milo: Age 5 | Whiskers: Age 9 | Felix: Age 13 |

|---|---|---|---|---|

| 1. Healthy Paws | $20 | $28 | $26 (Set plan: $750 deduct., 60% reimb., no annual limit) | $40 (Set plan: $750 deduct., 60% reimb., no annual limit) |

| 2. Pets Best - Plus Plan | $19 | $22 | $41 | $76 |

| 3. Nationwide - Whole Pet with Wellness | $33 ($100 deduct.) | $42 ($100 deduct.) | $64 ($100 deduct.) | $97 ($100 deduct.) |

| 4. Trupanion | $33 | $49 | $77 | $124 |

| 5. ASPCA - Complete | $26 | $31 | $48 | $88 |

| 6. Figo - Ultimate | $28 | $48 | $82 | $142 (Fixed $500 deduct.) |

| 7. Petplan | $33 | $51 | $101 | $175 |

Compared to dogs, pet insurance for cats is much less expensive. Premiums range from two-thirds the cost to lower than half as much. As with mixed-breed dogs, Pets Best and Healthy Paws come in on the low end. Petplan, Trupanion and Figo make up the high end.

Table D: $500 deductible for purebred American bulldog in San Diego

| Insurer/Plan Name | Duke: Age 1 | Rufus: Age 5 | Wags: Age 9 | Bruno: Age 13 |

|---|---|---|---|---|

| 1. Healthy Paws | $53 | $77 | $71 (Set plan: $750 deduct., 60% reimb., no annual limit) | $113 (Set plan: $750 deduct., 60% reimb., no annual limit) |

| 2. Pets Best - Plus Plan | $58 | $78 | $167 | $248 |

| 3. Nationwide - Whole Pet with Wellness | $96 ($100 deduct.) | $133 ($100 deduct.) | $207 ($100 deduct.) | $317 ($100 deduct.) |

| 4. Trupanion | $94 | $136 | $198 | $291 |

| 5. ASPCA - Complete | $62 | $75 | $141 | $198 |

| 6. Figo - Ultimate | $148 | $227 | $348 | $540 |

| 7. Petplan | $117 | $220 | $447 | $779 |

Purebred dogs and cats are more predisposed to hereditary disorders, and that’s reflected in each company’s higher rates. We selected five popular breeds known to have health issues: Cocker Spaniel, German Shepherd, American Bulldog, Rottweiler and Basset Hound. Our bulldog quote fell midrange, so that’s the one we’ve shared here.

For our five purebred categories, ASPCA just barely edged out Pets Best for lowest monthly premiums. Petplan and Figo were both substantially more for all five breeds, and in some cases were over three times as much as the lowest rates.

Table E: $500 deductible for purebred British shorthair in San Diego

| Insurer/Plan Name | Bandit: Age 1 | Milo: Age 5 | Whiskers: Age 9 | Felix: Age 13 |

|---|---|---|---|---|

| 1. Healthy Paws | $24 | $33 | $31 (Set plan: $750 deduct., 60% reimb., no annual limit) | $107 (Set plan: $750 deduct., 60% reimb., no annual limit) |

| 2. Pets Best - Plus Plan | $21 | $25 | $38 | $68 |

| 3. Nationwide - Whole Pet with Wellness | $36 ($100 deduct.) | $46 ($100 deduct.) | $70 ($100 deduct.) | $107 ($100 deduct.) |

| 4. Trupanion | $36 | $53 | $83 | $134 |

| 5. ASPCA - Complete | $34 | $40 | $63 | $114 |

| 6. Figo - Ultimate | $39 | $67 | $115 | $199 (Fixed $500 deduct.) |

| 7. Petplan | $38 | $60 | $118 | $205 |

We ran quotes for five feline purebreds: Persian, Maine Coon, British Shorthair (shown here), Abyssinian and Manx. Pets Best delivered notably lower rates across the board. Healthy Paws and ASPCA jockeyed for second place. Similar to purebred dogs, Petplan and Figo were significantly more expensive.

Table F: $1,000 deductible for mixed-breed Dog (medium) in San Diego

| Insurer/Plan Name | Duke: Age 1 | Rufus: Age 5 | Wags: Age 9 | Bruno: Age 13 |

|---|---|---|---|---|

| Pets Best - Plus Plan | $19 | $25 | $54 | $80 |

| Trupanion | $34 | $47 | $66 | $95 |

| Petplan | $40 | $73 | $146 | $253 |

Termed “catastrophic” coverage by some insurers, this approach sets your deductible at the upper limit. The idea is to greatly reduce your monthly premiums, but still have unlimited coverage for major illnesses or injuries. If you’re on a tight budget, you may find this an affordable option.

Of our finalists, only Trupanion, Pets Best and Petplan let you set a $1,000 deductible. Pets Best again offers lowest monthly rates. Trupanion follows not far behind. Petplan starts at twice the cost of Pets Best and only goes up from there.

Table G: Comprehensive+wellness, $500 deductible for mixed-breed dog

| Insurer/Plan Name | Duke: Age 1 | Rufus: Age 5 | Wags: Age 9 | Bruno: Age 13 |

|---|---|---|---|---|

| 2. Pets Best - Plus Plan | $60 | $72 | $125 | $173 |

| 3. Nationwide - Whole Pet with Wellness | $58 ($100 deduct.) | $80 ($100 deduct.) | $124 ($100 deduct.) | $190 ($100 deduct.) |

| 5. ASPCA - Complete | $72 | $82 | $130 | $172 |

If you’re the type of pet owner who really wants to optimize their pet’s well-being by sticking to annual exams and pushing preventive care, consider a wellness add-on. But be advised that tacking on a wellness rider will bump up your rates by roughly $25 per month. Over the course of year, that adds up to around $300; by contrast, a vet exam plus routine vaccines should cost under $100 (at time of this publication, it’s about $90 in San Diego). That’s why many pet owners elect to go with basic comprehensive coverage and pay for annual vet visits out of pocket.

Only Pets Best, Nationwide and ASPCA offer a comprehensive/wellness combo. Riding toward the middle of the pack thus far, Nationwide’s – Whole Pet with Wellness surges to the front in this category. This is the only plan they offer that has an unlimited annual payout, and it happens to come packaged with a full suite of wellness care. Take a look at their covered care summary. Considering it comes with a low $100 deductible that applies to other non-wellness treatments, this combo plan delivers incredible value.

Best overall: Healthy Paws

Healthy Paws uses one simple plan structure. Their single policy type is set at unlimited annual payout, so there’s no dollar cap to confuse new customers. All you need to do is pick your annual deductible ($100, $250 or $500) and co-pay (70, 80 or 90 percent). While they don’t offer a multipet discount, you can get reduced rates if you are a member of AAA, AARP or Costco.

When we spoke with Healthy Paws co-founder and CEO Rob Jackson, he emphasized the company’s goal is to provide a comprehensive plan that’s easy for consumers to understand. Rob shared their motto is “One plan. Four paws. All covered.” That straightforward approach is reflected in their policy, which uses plain language and isn’t bogged down with jargon and legalese.

In terms of cost, Healthy Paws offers some of the lowest monthly premiums on the market. As with most plans, the sooner you enroll, the lower your rate will be. Pets must be at least eight weeks old to enroll. Be aware that Healthy Paws does not cover hip dysplasia for pets that begin coverage after they turn six years old.

Like our other finalists, Healthy Paws covers all major illnesses and injuries; hereditary and congenital conditions; chronic conditions like cancer; plus diagnostic treatment, surgery and hospitalization. They also pay for prescription medications and cover “alternative care” for acupuncture, chiropractic and hydrotherapy at no extra cost, where some insurers require a wellness add-on.

To keep rates low, Healthy Paws doesn’t cover preventive care, which applies to vaccinations, flea control, heartworm medication, deworming, nail trimming, dental cleaning, spaying or neutering. Nor do they cover exam fees, even for covered conditions; that’s unfortunate, but tolerable if it keeps premiums affordable.

Healthy Paws earned the highest customer scores on all five review sites that we researched. We really can’t undervalue the hefty number of glowingly positive customer reviews. With over 4,200 reviews on Pet Insurance Review, a 9.8 score is fairly astounding. Customers praise the staff’s communication, hassle-free claims process and speedy payment.

There are a few specific limitations you should be aware of. First, newly enrolled pets must have a one-time pet exam, which helps identify any pre-existing conditions. Second, Healthy Paws applies a lengthy 12-month wait period for hip dysplasia, a common ailment for dog breeds such as Labrador retrievers. This type of hip disease can be common in dogs under age one, so talk to your vet about the risks before enrolling.

Healthy Paws also limits plan options for older pets. If you enroll your pet after their eighth birthday, you still get unlimited coverage, but you’re forced to go with a $750 annual deductible and your co-pay is set at 40 percent. That can be a big cost hit if your vet bill climbs into five digits. Still, if you compare other insurers’ rates for newly enrolling older pets, Healthy Paws’ premiums are the only ones most people can afford.

According to the Healthy Paws home page, they process 99 percent of claims in just two days. You can easily submit a claim by uploading a photo of your vet bill through their mobile app. Reimbursement typically takes three to 10 days. Their support department let us know they once paid out $60,000 to cover a single claim.

Aside from the wait period hurdles you need to navigate, the Healthy Paws plan is all positives. It’s not hard to see why they score so high in both consumer and professional reviews.

Key takeaways:

- Healthy Paws’ single plan option is straightforward and policy language is easy to understand.

- Premiums are lower than most other insurers, especially if you enroll while your pet is young.

- Healthy Paws has the highest customer scores on all major pet insurance review websites, reporting stellar service and quick claim payments.

- For new enrollees, there is a lengthy 12-month wait period for hip dysplasia.

- Pets that enroll at age 8 or older must use a fixed plan with only 60 percent reimbursement (40-percent co-pay).

Best rates: Pets Best – BestBenefit Plus Plan

In our quote research, the Pets Best – BestBenefit Plus Plan repeatedly delivered the lowest monthly premiums of all seven contenders. A good plan is not all about price, but it’s certainly an important factor. With all the different categories we ran quotes for, we put our finalists to the test and were surprised by Pets Best’s consistently low rates.

Pets Best was founded by Dr. Jack Stephens, who back in 1981 helped launch the first pet insurance company in North America. As a practicing veterinarian, Dr. Stephens recognized how tragic it is for pet parents to have to put their animals down simply because they couldn’t afford treatment. As a result, the Pets Best mission is to end economic euthanasia. That helps explain why their rates are so affordable.

Regarding plan structure, Pets Best offers three different plans, but they are very similar. The mid-tier “Plus” plan adds coverage for exam fees associated with an eligible illness or injury (not included with their basic “Essential” plan). And the top-tier “Elite” plan further adds on rehab for special care like acupuncture or chiropractic. We went with the “Plus” plan for solid coverage at reasonable rates.

Lowest Rates: Pets Best - BestBenefit Plus Plan

Across the board, Pets Best offers the lowest rates we could find for both mixed breeds and purebreds. Plans are highly customizable, and this mid-tier plan also reimburses for exam fees associated with a covered condition, a bonus not offered by all insurers.

Pets Best offers lots of flexibility to set your annual deductible and reimbursement percentage — just be sure to select the “Unlimited” annual limit. Though we prefer to pay for annual exams out of pocket, Pets Best does offer two different wellness add-ons, priced around $15-$25, that cover annual exams and preventive care. As an additional option, they provide a 5-percent multipet discount if you have more than one pet.

Wait periods are reasonable at 14 days for illness coverage and just three days for injury. The exception is cruciate ligament conditions, which have an extended six-month waiting period that cannot be waived by exam.

Pets Best touts that they process most claims in just three to five days. They also offer direct deposit, plus a “Vet Direct Pay” option. Once you submit paperwork for payment directly to your vet, that provider will remain on file for the next time you need to pay vet fees.

With all the (good features/positives), we might have considered Pets Best for our top pick were it not for some mixed customer reviews. Comments on Pet Insurance Review and Trustpilot are largely on the positive side. But Pets Best didn’t score nearly the same rave reviews as Healthy Paws, which led us to rank them a runner-up, still a very solid showing.

Key takeaways:

- Pets Best – BestBenefit Plus Plan consistently yielded the lowest monthly premiums when we ran our quote comparisons.

- Highly customizable plans, including a midrange “Plus” plan that covers exam fees for covered conditions, which some other insurers exclude.

- Most quotes are processed in a quick three- to five-day turnaround time.

- Wait period is extended to six months for cruciate ligament conditions.

- Pets Best receives mostly positive reviews, though some customers complain about arguing with their claims department over whether their pet’s condition is covered.

Best wellness plan: Nationwide – Whole Pet

Among our finalists, Nationwide’s – Whole Pet with Wellness plan is unique in that it combines comprehensive with wellness care. It’s also Nationwide’s only plan that uses an unlimited payout. The extra benefit means you’re not going to get the lowest rates, but you do get a lot of bang for your buck.

Be sure not to confuse this “Whole Pet” plan with Nationwide’s “Major Medical” — that plan uses a benefits schedule that limits payouts based on line-item pricing (think of it as a menu for each type of treatment). Also, be aware their “Pet Wellness” plan only covers routine exams and preventive care, and not the injuries and illnesses covered by a comprehensive plan.

Once you clear those two hurdles, there is very little that’s confusing about the Whole Pet with Wellness plan. And that simplicity is one of its merits. Rather than choose between deductible and co-pay options, the Whole Pet plan is fixed at an unlimited annual payout, a $100 deductible and a 10-percent co-pay. For a fixed plan, those are very favorable settings.

To hammer that point home, not only do you get to use a low $100 deductible for any illness or injury, you also get a highly inclusive wellness package — routine exams, vaccinations, flea and tick control, dental cleaning, behavioral care, dietary supplements — if you can think of it, it’s probably on the list.

Considering overall value, Whole Pet monthly premiums are very reasonable. Compared to our other plans at a $500 deductible (and without wellness), Whole Pet falls right in the middle. At a $250 deductible, Whole Pet is as low or less than the competition.

In terms of restrictions, dogs must be at least age 1 and under age 10 to enroll (no such restriction on cats). The wait period is 14 days for both illness and injury. Unlike some other insurers, there are no special wait periods for hip or knee conditions.

Consumer comments on Pet Insurance Review are for the most part complimentary. You need to look closely because the major complaints we saw were all regarding Nationwide’s Major Medical; we agree, that’s not a good option. Other, minor comments suggest that their claim processing should be faster.

As a company, Nationwide has been in business since 1925. Their pet insurance division was originally Veterinary Pet Insurance (VPI) — who, by the way, issued the very first pet policy to Lassie — founded in 1982 and acquired by Nationwide in 2014. With such established history, you can depend on Nationwide to be around for the long run.

When we started this review, we didn’t set out to consider wellness care. Yet, we sure came to appreciate this plan’s value. Nationwide’s Whole Pet with Wellness was another strong contender for our top pick. But we think pet insurance should be affordable by as many pet parents as possible, and that means going with a lower-priced plan that doesn’t attach the extra cost of wellness coverage.

Key takeaways:

- Nationwide – Whole Pet with Wellness covers the entire range of vet services by combining comprehensive illness and injury with extensive wellness care.

- This is the least confusing plan available because all variables are fixed — favorably so: $100 deductible, 10-percent co-pay and unlimited annual payout.

- Unlike many other insurers, there are no special wait periods.

- As a highly respected company with over 90 years in business, you can count on Nationwide being there for the long run.

- This all-encompassing plan can’t compete against the low rates of plans that forego wellness, yet it still delivers incredible value at a reasonable price.

Other finalists we evaluated

Honestly, our research suggests that all of our seven finalists provide great coverage that we would not hesitate to recommend. Put another way, each of these pet insurance companies can provide that essential “peace of mind” from knowing your favorite companion will receive whatever emergency vet care is required, regardless of expense. It really comes down to the fine details and the fact that some insurers’ rates are higher than others.

Trupanion

Trupanion led the way in offering a streamlined plan that helps prevent customers getting overwhelmed. Their one policy comes with unlimited annual payout and 10-percent co-pay. You just need to choose your deductible, which can be set at one-dollar increments from $0-$1,000.

Trupanion is the only company that uses a “per incident” deductible: For each condition your pet develops, you pay vet fees up to your deductible; once you meet the threshold, that condition is covered for the life of your pet, though you’re still responsible for the co-pay. The risk is that you may have to pay multiple deductibles if you have an unlucky or accident-prone pet who requires more than one vet visit.

Most Innovative Claim Structure: Trupanion

If your pet first comes down with an ailment while covered by Trupanion, the company’s unique “per incident” deductible covers treatment for that specific condition for the life of your pet. Customers also report that Trupanion is quick to issue reimbursement.

Another unique feature is Trupanion’s “Vet Direct Pay” system. Trupanion pioneered the way for paying vets directly. This minimizes your out out-of-pocket expenses. Most other companies now also offer direct pay, but they make you do the legwork to process a “veterinarian release form.” Trupanion runs a dedicated software system connected to vet offices. Vets need to opt into the system, but once they do Trupanion can issue payment within minutes of your checkout.

According to Trupanion’s website, they settle 65 percent of claims on same day received, and 80 percent within seven days. Another plus is that they don’t require any special extended wait periods. In reviewing Trupanion’s policy doc, we noted your pet needs to receive required vaccinations or they won’t be covered for those specific conditions.

Trupanion’s reviews are nearly as high as Healthy Paws on Pet Insurance Review and slightly less favorable on Trustpilot. Founded in 2000, Trupanion has built a strong reputation. With all their innovative features, we were inclined to push them into the winner’s circle. But when we compared quotes, Trupanion frequently came in third most expensive. If rates were lower, they’d surely be a contender.

ASPCA – Complete Coverage

Formerly the Hartville Pet Insurance Group, this Crum & Forster company formed a strategic partnership in 2006 with the American Society for the Prevention of Cruelty to Animals (ASPCA). Similar to Pets Best, their plan is highly customizable. The ASPCA – Complete Coverage plan also offers very reasonable rates, coming in third place just behind Pets Best and Healthy Paws.

ASPCA is one of our few finalists to pay for vet exams that are part of diagnosing a covered condition. Wait periods are short and there are no special extensions for hip or knee conditions. They also cover vet-prescribed medications and foods needed to treat an ailment.

Other insurers offer a multipet discount at 5 percent (if they offer it at all), but ASPCA provides customers a 10-percent discount for enrolling more than one pet. That’s a nice perk if you’re wrangling a small herd of beagles.

ASPCA has a good ranking on Pet Insurance Review and an even better score on Trustpilot where it’s second only to our top pick, Healhy Paws. We honestly have nothing bad to report about ASPCA. The only reason they’re not one of our top picks is that they didn’t stand out in certain categories like others.

Figo

Started in 2015, Figo is a newcomer to the scene. They offer three comprehensive plans, but only the Figo – Ultimate plan offers unlimited annual payout. Unlike other companies, Figo’s deductible options vary by age: $100-$750 for pets eight weeks to five years; $250-$1,000 for pets aged six to nine years; and $500-$1,500 for pets 10 years and older.

Figo imposes short wait periods of five days for accidents/injuries and 14 days for illnesses. The exception is cruciate and patella (knee) injuries, which have a six-month wait period; however, that requirement can be waived if a vet examines your pet within the first 30 days and confirms no pre-existing condition.

On the downside, Figo yielded the second highest premiums for most of our quote categories. Only Petplan came in higher. Figo also offers an add-on to cover exam fees — but this only applies to covered illnesses and injuries, and not to routine exams or preventive care. We think there are better options out there.

Petplan

Petplan offers a high degree of customization. However, when we ran our quotes, we found Petplan consistently had the highest monthly premiums. Some rates were two-to-three times as much as lower-cost competitors, especially for older pets.

Another drawback, Petplan is our only finalist to require an annual vet checkup and dental exam (plus any specific periodic treatment “suggested” by vet to prevent illness or injury). Failure to have an annual checkup means that any new conditions discovered at next vet exam will be used as a basis for pre-existing conditions, for which you will not be covered.

Petplan has decent customer reviews and over 40 years in business, but the above issues led us to steer clear of picking them as a winner.

The bottom line

Pet insurance is one of those rare, pricey things in life that you hope you never need to use. No one wants their pet to get sick or hurt, but it sure is comforting to know you’ll be covered if it happens.

Healthy Paws gives pet parents peace of mind. Customers applaud their excellent customer service and smooth claims process, which has earned them the highest consumer review scores on both Pet Insurance Review and Trustpilot, Unlike our other finalists, we couldn’t find a single complaint about being denied coverage for a claim.

In terms of rates, Healthy Paws offers some of the lowest monthly premiums available. Just be sure to enroll early, as limitations start to apply after your pet turns six-years-old. We also appreciate their simple plan structure that’s easy to understand and doesn’t overwhelm with numerous decisions to be made.

If lowest rates are your top priority, run a quote for Pets Best – BestBenefit Plus Plan. You’ll be challenged to find a better monthly premium. Not only does their plan allow a high degree of personalization, but they are our only finalist who that offers both high-deductible plans and wellness add-ons.

If you’re willing to spend a bit more to get more, you can reap the benefits with Nationwide’s Whole Pet with Wellness. This plan covers about every vet service you can think of, including all routine exams and all sorts of preventive care. And if you’re looking to insure a feathered friend, Nationwide’s Avian & Exotic Pet Plan is the only policy that covers pets other than dogs and cats.

For more pet care, check out our review of the best pet gates and our review of the best automatic litter box.

More Reviews

DELOMO - Pet Hair Roller

The 7 Best No-Pull Dog Harnesses

Auroth - Tactical Dog Harness

The 9 Best Back Seat Covers For Dogs

Plush Paws Products

Castor & Pollux - Organix

Shark - NV350

The Best Automatic Litter Boxes

Pet Zone - SmartScoop

Mac Sports - Heavy Duty

Safety 1st - Bamboo Gate

Shiny Pet

Litter-Robot 4 Review: Cat-Testing a $700 Litter Box

Litter-Robot 4

CatGuru - Heavy Duty Cat Litter Mat